Becoming Digital – the digital transformation journey for banks.

Board members and CXO’s continue to be bombarded by different messaging and the potential around digital banking.

Although the simplistic view was that digital banking is just about having a mobile app which allows customers to check balances and make payments – it is now widely understood that digital banking is more, much more. At Stoughton, we have an evolutionary approach for legacy banks to work towards becoming a digital bank as organisational behaviour and capability rarely can be changed overnight.

We take our clients on a 4 stage journey to being digital.

Exploring Digital

Leverage traditional technologies to automate existing capabilities

Doing Digital

Use digital technologies to extend capabilities, but still largely focused around current business, operating, and customer models

Becoming Digital

Accelerate usage of digital technologies to become more synchronized and less silo’d, with more advanced changes to current business and customer models

Being Digital

Transform Business, operating and customer channels leveraging exponential technologies to run the bank profoundly differently than prior models

This intentional journey requires banks to answer 3 key questions:.

HOW DIGITAL ARE YOU TODAY?

It is critical to understand your organization’s level of digital maturity today so you know where to begin and where to leverage.

Scanning beyond your peers is critical as the onset of digital banking means the industry is now competing cross industry and borders.

HOW DIGITAL DO YOU WANT TO BECOME?

Critically, the question ‘what do your customers want you to become’ should be the starting point.

Recognizing where you need to get to in 6-12-24 months helps prioritize focus, energy & investments.

HOW DO YOU GET THERE?

Digital transformation is a journey.

Change happens more rapidly when you infuse digital traits and characteristics into the existing legacy environment to ensure a smooth transition for your customers

There are no one-set of correct answers here which executives can simply adopt. The requirements is to understand the value proposition of the existing bank, the desire of the customers, the willingness to change to a new value proposition and the ambition of the Board to back and implement the change.

Each bank will have to go through their own journey – to defining their digital strategy and how to bring it to life.

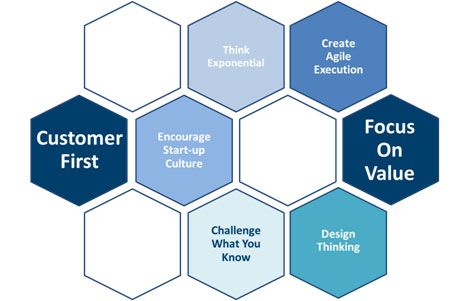

Becoming digital will require deep planning and analysis so as not to negatively disrupt the existing business and customers. We have identified 7 aspects which can go into the design principles of any transformation journey.

At Stoughton, our experienced team have facilitated banks through defining their strategy and through the implementation journey. With a team of consultants and practitioners, we understand the challenges banks are facing

Connect with our digital team to see how we can support you and your bank to becoming digital.

About Us

Stoughton Associates is a management consulting firm which provides strategy and implementation delivery experience for the financial services industry incumbents, new entrants and regulators with leadership and deep domain expertise.

Address

info@stoughton.xyz

+44 207 193 1832

71-75 Shelton Street

London, WC2H 9JQ

United Kingdom

Follow Us