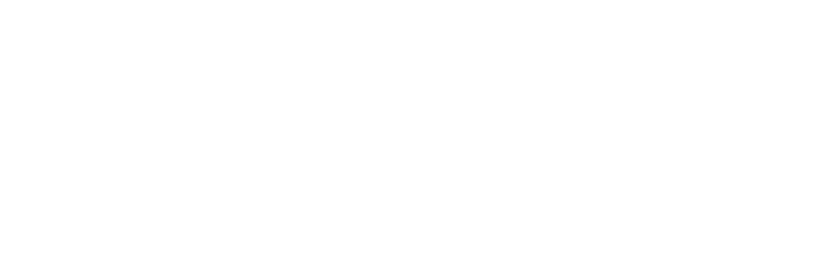

What is ‘Digital Strategy

A well-defined digital strategy is essential to achieving value from any digital solution. With our digital expertise, Stoughton is uniquely qualified to help you establish one.

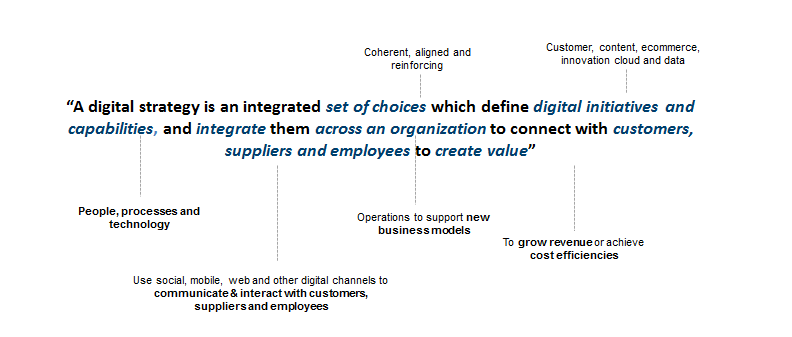

Major Trends Re-shaping The FS Industry

Technology advances and corresponding societal shifts have transformed ways of working, leading to the need for companies to rethink how they create value for customers and capture value for themselves

Strategy has to be ‘Digital First’

The banking industry has changed beyond recognition in the last 10 years. With customers adopting digital channels for sales and service, banks have been left with legacy distribution costs, an increasingly diversified competitive landscape and an

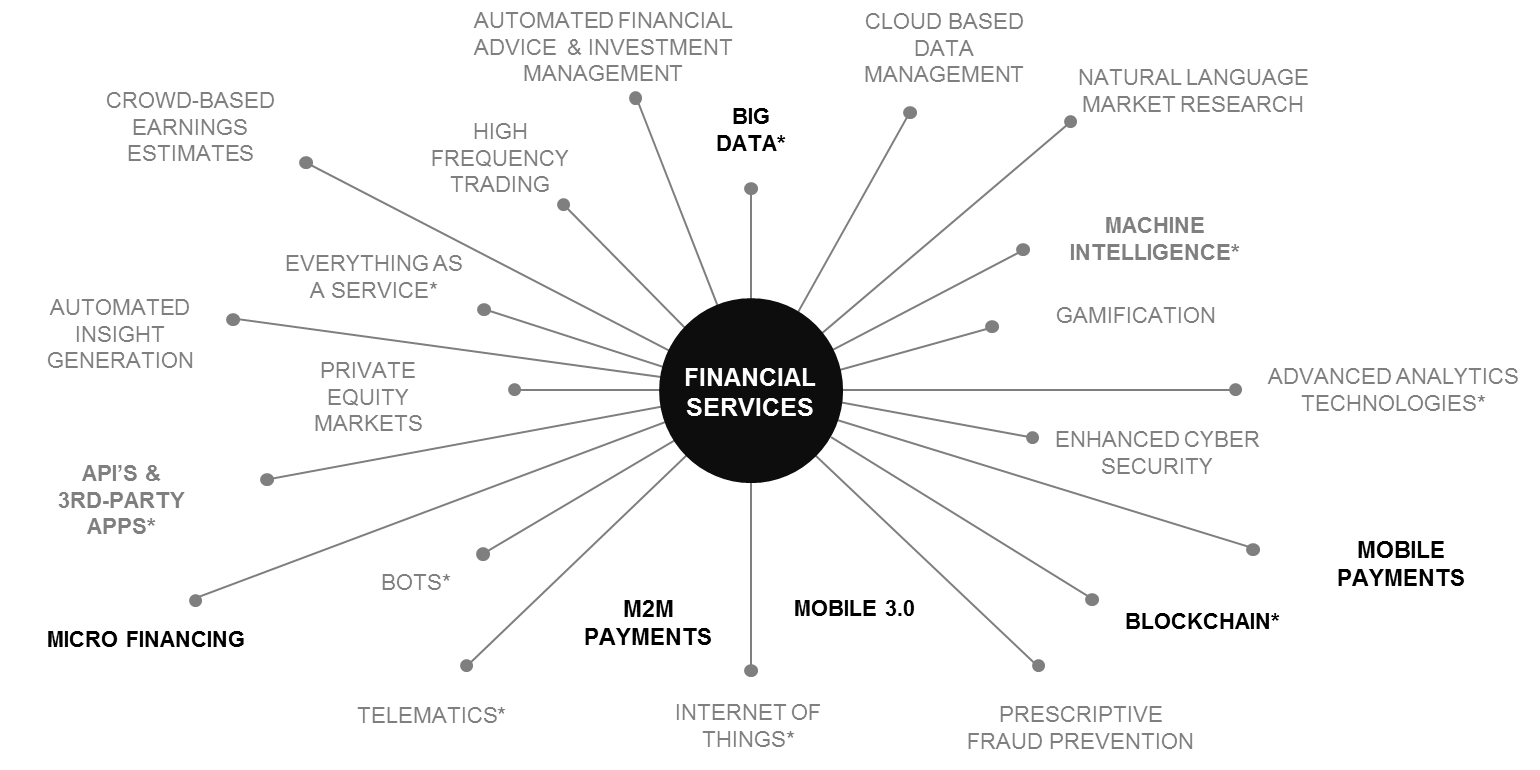

The industry has to change the traditional approach to developing a

With technology evolution now faster than ever before, 5 years is almost an eternity for a bank to remain with the same strategy. Since 2014, the industry has seen disruption from new non-traditional banking industry entrants, regulatory evolution, data propagation, new payment platforms. Even the disruptors are being disrupted.

Think beyond traditional banking

With technology evolution now faster than ever before, 5 years is almost an eternity for a bank to remain with the same strategy. Since 2014, the industry has seen disruption from new non-traditional banking industry entrants, regulatory evolution, data propagation, new payment platforms. Even the disruptors are being disrupted.

Banks need to take a new approach to

So where should you start?

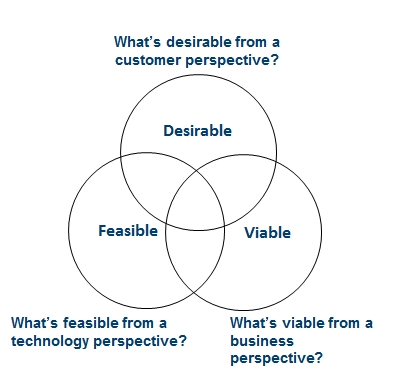

Every bank has to look at three dimensions:

- Desirable

- Feasible

- Viable

And the start has to be what the Customer wants as this is at the heart of being a sustainable business. Customers are seeking anytime, anywhere banking to do their banking on their agenda in their time.

What’s possible with digital?

Let’s take personal finance – customers can now make applications for a loan on their smartphone in minutes leveraging digital capability across the organisation from KYC, credit analysis, credit approval, repayment schedules, digital signatures, disbursement and collections. This is what customers want and what banks need to offer.

From Digital Strategy to Becoming Digital

By moving towards becoming digital, each stage in developing the overall strategy takes consideration of the organisation maturity across a number of factors and how they must change – starting with the culture, mindset, capability and behaviour.

With technology becoming the core enablement factor, it is critical to design the conceptual technology roadmap once the inputs have been clearly identified from business and customer strategy and the business and operating model.

Even the best of strategies can remain unfulfilled due to poor understanding of what the change journey looks like and/or remaining fixed on course for the duration without adapting quickly enough to external factors. Becoming Digital means being agile, building a platform to integrate, supporting talent across the organisation to shift gear in performance.

About Us

Stoughton Associates is a management consulting firm which provides strategy and implementation delivery experience for the financial services industry incumbents, new entrants and regulators with leadership and deep domain expertise.

Address

info@stoughton.xyz

+44 207 193 1832

71-75 Shelton Street

London, WC2H 9JQ

United Kingdom

Follow Us