Mobile Financial Service POV

Are you a Telecom or FS player?

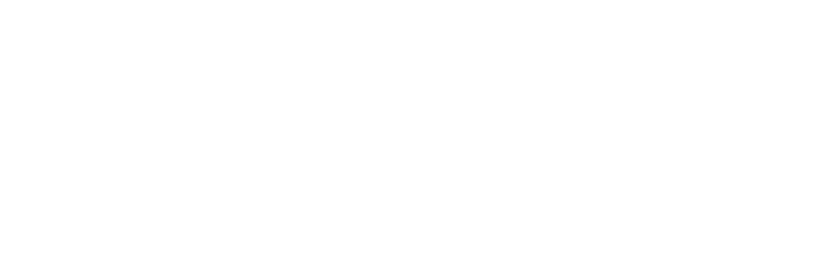

272 Deployments across 90 countries would have answered ‘Both’ to the question above in 2018

Telcos and FinTechs are challenging status quo

Backed by regulations, telcos and fintechs across the globe have evolved from front end channels to integrated digital financial services providers

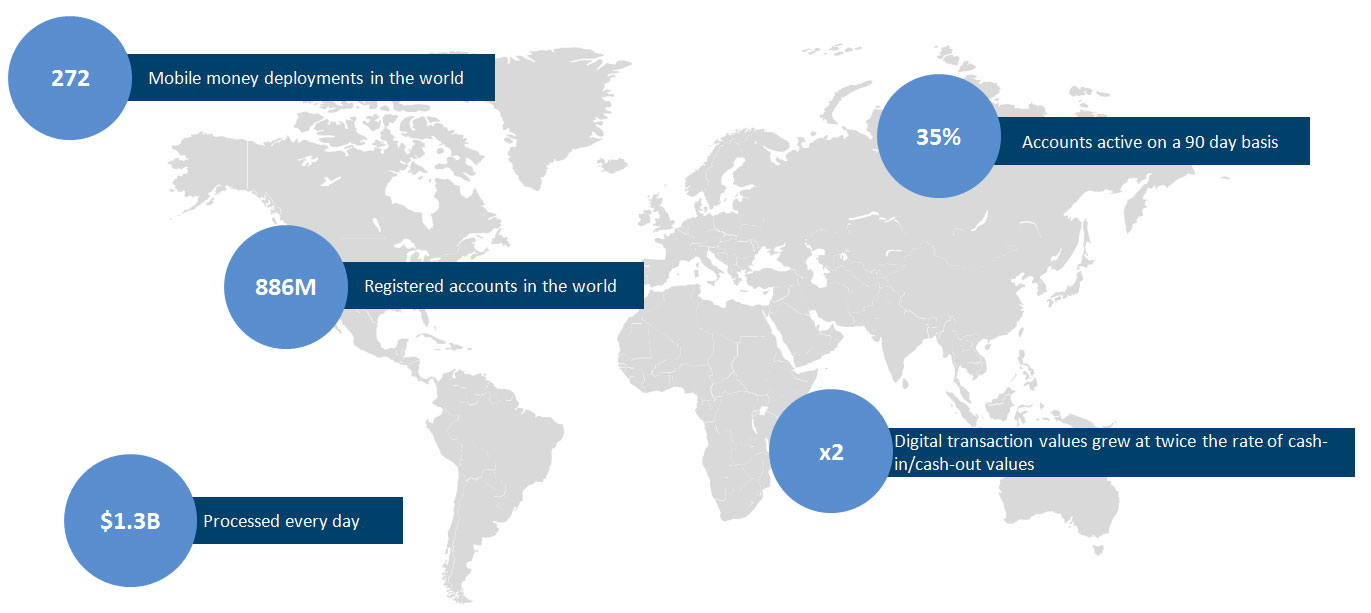

Technology migration to continue increasing

As internet penetration increases, role of telecom and FinTech players will increase in the coming years

With the uptake of 3G and 4G services, shift towards digital banking is going to accelerate while the launch and uptake of 5G services will introduce new use cases for telecom and financial services players including IoT.

Technology migration to continue increasing

As internet penetration increases, role of telecom and FinTech players will increase in the coming years

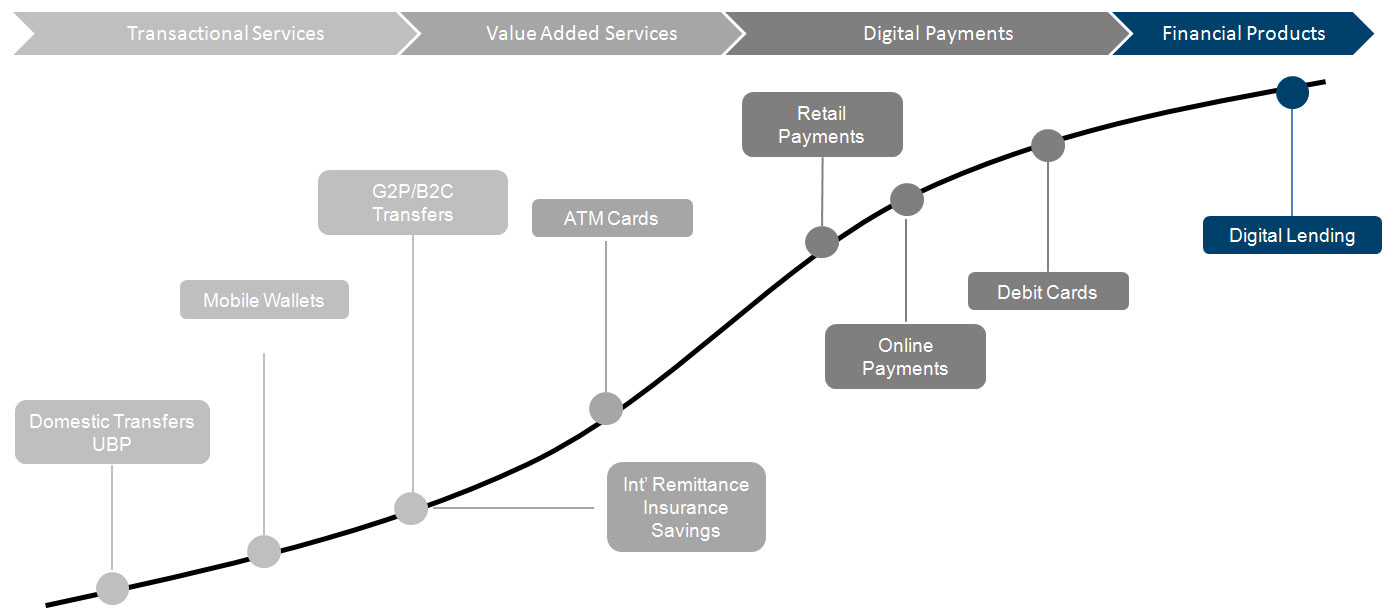

Evolution from basic to integrated FS offering

Sample journey of a basic Mobile Financial Services player to an integrated Financial Services Provider

Case in Point

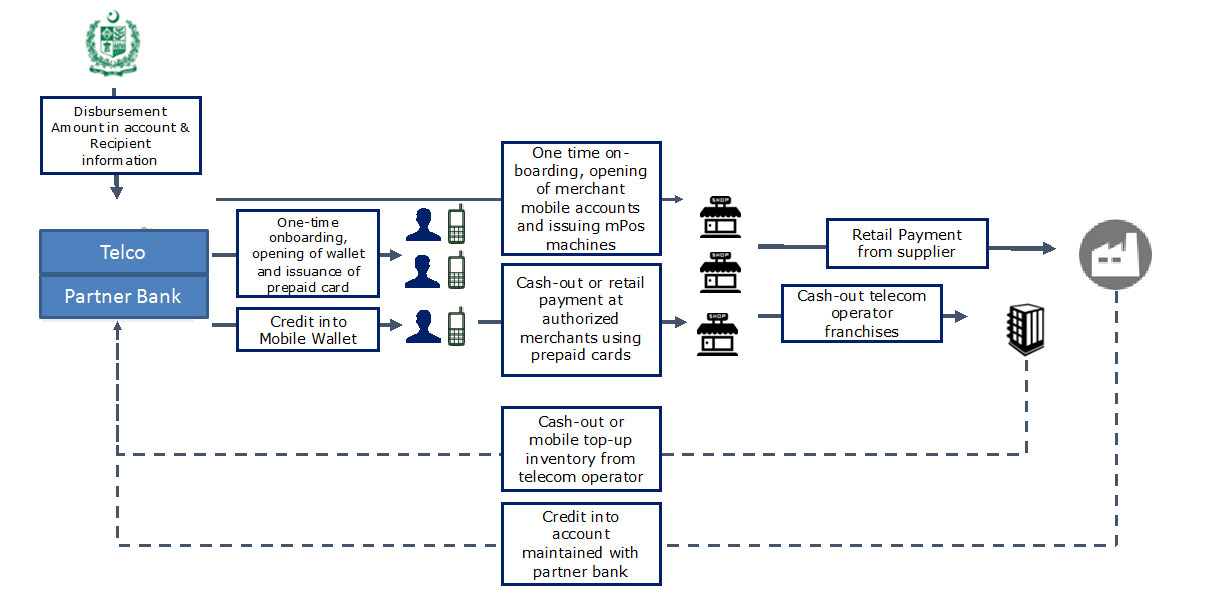

Example of Digitalization of Government to People (G2P) in an Asian Country

About Us

Stoughton Associates is a management consulting firm which provides strategy and implementation delivery experience for the financial services industry incumbents, new entrants and regulators with leadership and deep domain expertise.

Address

info@stoughton.xyz

+44 207 193 1832

71-75 Shelton Street

London, WC2H 9JQ

United Kingdom

Follow Us