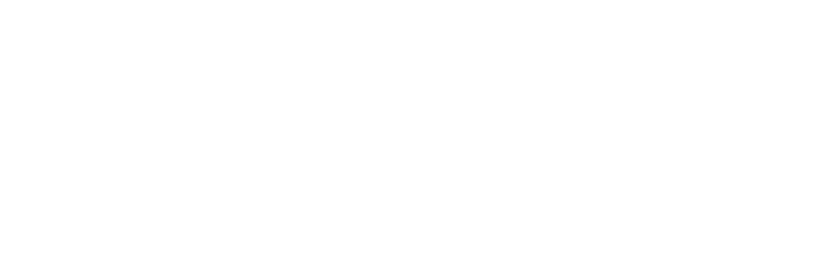

Digital disruption is accelerating – banks need to disrupt themselves or they will start to lose customers faster than they can acquire new ones.

We are now at a cross roads for financial institutions of all sizes – business as usual is not an option. The longer financial institutions delay the transition the sooner they will become irrelevant. Digital banks are here, more are coming, and they have no legacy infrastructure, products or operating models – they have no fears of starting small, they will attract customers based on their digital platforms and customer experience.

Executives and Shareholders no longer have the luxury of doing nothing and riding out the storm – its decision time to drive the change or be acquired. Although banking as we know it has been around for hundreds of years, this type of industry level transformation is happening for the first time.

Where we assist our client

Fundamental change with the help of experienced experts is the way forward. Our team has worked with leading institutions in the banking, insurance and asset management sectors in all major areas.

Regulators

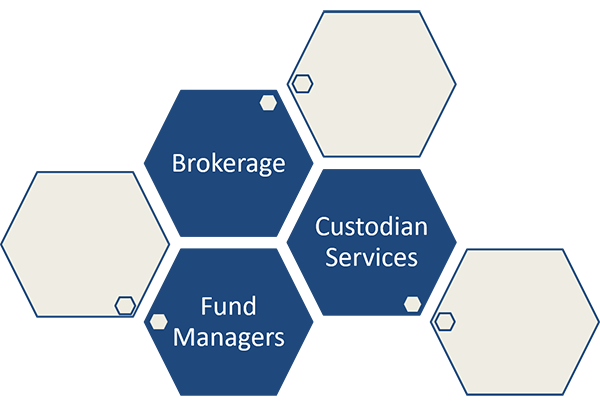

Banking

Payments

Insurance

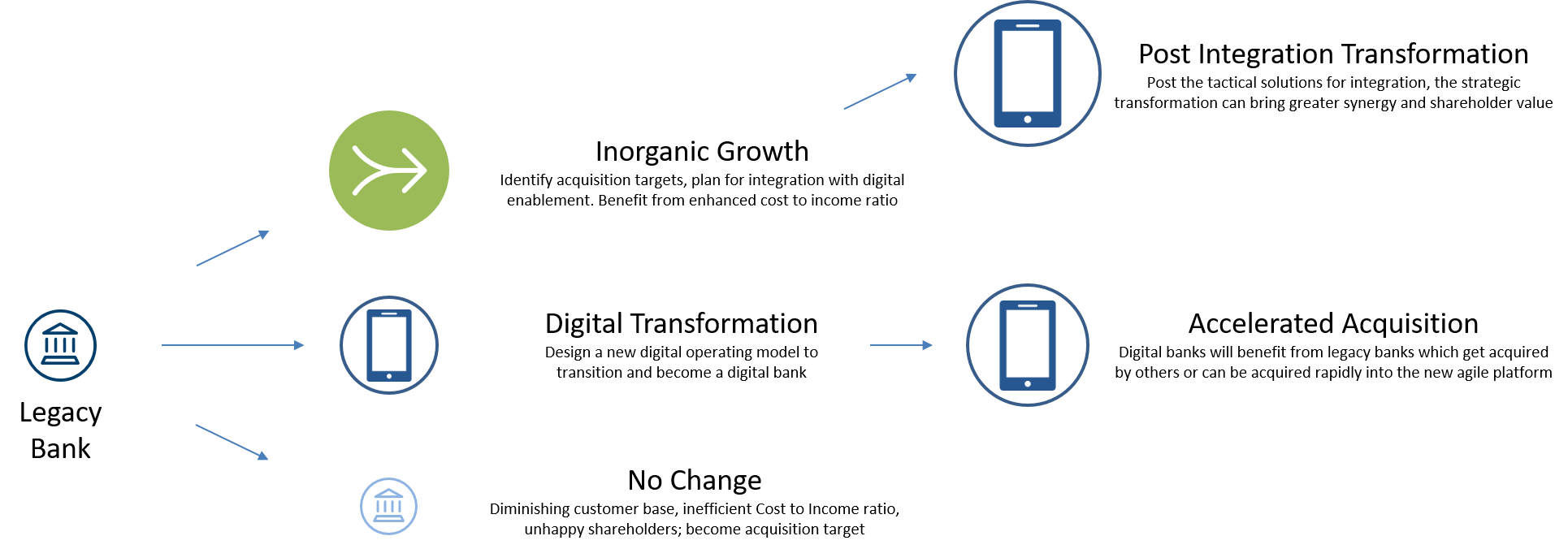

Asset Management

Government

About Us

Stoughton Associates is a management consulting firm which provides strategy and implementation delivery experience for the financial services industry incumbents, new entrants and regulators with leadership and deep domain expertise.

Address

info@stoughton.xyz

+44 207 193 1832

71-75 Shelton Street

London, WC2H 9JQ

United Kingdom

Follow Us